1670-72 Wavendon Hearth Tax Exemptions

Wikipedia’s explanation of the English Hearth Tax:

In England, hearth tax, also known as hearth money, chimney tax, or chimney money, was a tax imposed by Parliament in 1662, to support the Royal Household of King Charles II. Following the Restoration of the monarchy in 1660, Parliament calculated that the Royal Household needed an annual income of £1,200,000. The hearth tax was a supplemental tax to make up the shortfall. It was considered easier to establish the number of hearths than the number of heads, hearths forming a more stationary subject for taxation than people. This form of taxation was new to England, but had precedents abroad. It generated considerable debate, but was supported by the economist Sir William Petty, and carried through the Commons by the influential West Country member Sir Courtenay Pole, 2nd Baronet (whose enemies nicknamed him “Sir Chimney Poll” as a result). The bill received Royal Assent on 19 May 1662, with the first payment due on 29 September 1662, Michaelmas.

One shilling was liable to be paid for every firehearth or stove, in all dwellings, houses, edifices or lodgings, and was payable at Michaelmas, 29 September and on Lady Day, 25 March. The tax thus amounted to two shillings per hearth or stove per year. The original bill contained a practical shortcoming in that it did not distinguish between owners and occupiers and was potentially a major burden on the poor as there were no exemptions. The bill was subsequently amended so that the tax was paid by the occupier. Further amendments introduced a range of exemptions that ensured that a substantial proportion of the poorer people did not have to pay the tax.

Exemptions from the Hearth Tax

- Not paying Poor or Church Rates

- Inhabiting a house, tenement or land worth less than 20 shillings (£1) rent per annum

- Assets worth less than £10

- Private ovens, furnaces, kilns and blowing houses

- Hospitals and almshouses where revenue less than £100 per annum

Exemption certificates had to be signed by a minister, a churchwarden, or an overseer of the poor and two Justices of the Peace. From 1664, everybody whose home had more than two hearths was liable to pay the tax, even if otherwise exempt, and changes were made to reduce the scope for tax avoidance.

Revenue generated in the first year was less than expected, so from 1663, the names and number of hearths were required to be listed even if non-liable. This additional detail has made the relevant hearth tax documents particularly useful to modern historians and other researchers. However, details of householders who were not liable to pay the tax were not recorded for all years of its operation, as they were not needed for audit purposes when the right to collect the tax was “farmed” for collection by contractors in return for their payment of a fixed premium.

The arrangements for collecting the hearth tax varied during its lifetime:

- 1662 to 1664: The tax was collected by petty constables, with supervision and administration through the existing machinery of local government.

- 1664 to 1665: Receivers (commonly known as “chimney-men”) were appointed specifically to collect the tax.

- 1666 to 1669: The right to collect the tax was leased or “farmed out” to three City of London merchants, in exchange for a premium.

- 1669 to 1674: A central government office called “Agents for the Hearth Tax” supervised collection by directly employed receivers.

- 1674 to 1684: The tax was again farmed out.

- 1684 to 1689: A special government commission collected both the excise and hearth tax.

The tax fell most heavily on those who occupied the houses with the greatest number of hearths. For instance, in 1673-4 the Earl of Exeter had to pay for 70 hearths at Burghley House. In contrast, most householders who were liable to pay tax had only one or two hearths and a significant proportion of householders were not liable to pay at all.

The hearth tax was much resented because it often entailed inspection of the interior of dwellings by the sub-collectors and petty constables, who had legal authority to enter every property to check on the number of hearths. Some people stopped up their chimneys so that the tax was not due on them, but where this was discovered by the assessors the tax was doubled. On 31 July 1684, a fire in Churchill, Oxfordshire, destroyed 20 houses and many other buildings, and killed four people. It was apparently caused by a baker who, to avoid chimney tax, had knocked through the wall from her oven to her neighbour’s chimney. Sir Courtenay Pole, its principal author, was attacked for having devised “the most vexatious tax on the people that ever was known.”

After the Glorious Revolution, the hearth tax was repealed by the newly empowered English Parliament and agreed to by the newly installed William III and Mary II in 1689, as not only a great oppression to the poorer sort, but a badge of slavery upon the whole people, exposing every man’s house to be entered into, and searched at pleasure, by persons unknown to him.

At the end of the Glorious Revolution in 1688, William III and Mary II also agreed to and signed the English Bill of Rights 1689 marking a new level of co-operation and power sharing between the Parliament and the English monarchs. The cancellation of the hearth tax and the signing of the Bill of Rights, etc. led to a greater measure of legal protection for life, liberty, and property in England that encouraged and empowered the middle class at the beginning of the Industrial Revolution. This action both signalled the end of several centuries of tension and conflict between the crown and parliament, and the end of the idea that English kings had any divine rights and that England would be restored to Roman Catholicism. The new King William III and his wife Mary II were Protestant leaders from the Dutch Republic who were invited by Parliament to rule England. To make up for the loss of tax revenue, due to the cancellation of the hearth tax, uniform property taxes were imposed with few exclusions.

The National Archives at Kew hold three lists of those too poor to pay the hearth tax in Wavendon, compiled in 1670, 1671 and 1672. These are the names recorded on them:

1670

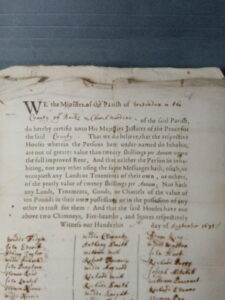

Wee the Minister of the Parish of Wavendon & other of the inhabitants of the said Parish doe hereby Certifie unto his Majesties Justices of the Peace for the said County of Bucks That we doe believe That the respective Houses wherein the persons hereunder named doe Inhabit are not of greater value than twenty shillings per annum upon the full Improved rent, And that neither the person so inhabiting, nor any other using the same Messuages hath, useth, or Occupieth any Lands or Tenements of their own or others of the yearly value of Twenty shillings per annum , Nor hath any Lands, Tenements, Goods or Chattels of the value of Ten Pounds in their possession, or in the possession of any other intrust for them. And that the said houses have not above two Chimneys, Fire-hearths and Stoves in them respectively. Witness our hands this 26 day of September 1670.

Widdo Figgin

John Everatt

Widdo Henson

Thomas Read

John Pangburne

Thomas Norris

Widdo Norris jnr.

Widdo Norris snr.

Widdo Fitzhugh

Joane Page

George Abnell

Widdo Quaint

Waltnee Taperto

Widdo Warrin

Thomas Abnell

Widdo Ann Barret

John Ratley

Widdo Charnake

Anthony Smith

William Wall

Robert Francis

Widdo Maynard

Richard Wall

Richard Smith

Widdo Knight

Wid. Mar. Fitzhugh

Thomas Man

Thomas Burten

Robert Page

Thomas Ashby

Widdo Morgan

Widdo Walton

Thomas Barnard

George Cooper

Richard Perry

Joseph Mitchell

William Pancrust

Richard Evans

Long Slad Peeople [unclear if this is a heading which applies to the names below, or a general entry for those dwellings in the Longslade Lane area. ]

Thomas Pye

Richard Pancrust

Widdo Sutton

John Butler

Widdo Gregory

James Johns

[Signed by]

Adam Booker, Rector

Tho. Gregory

Thomas Sanders

William Parratt

Tho. Garrett

John Collins

We allow this certificate containing 45 names.

Tho. Duncombe

Brett Horton

____________________________________________

1671

We the Minister of the Parish of Wavendon in the County of Bucks and Church Wardens Overseers of of the said Parish, do hereby Certifie unto His Majesties Justices of the Peace for the said County That we do believe, that the respective Houses wherein the Persons here under-named do Inhabit, are not of greater value than twenty shillings per Annum upon the full improved Rent; And that neither the Person so inhabiting, nor any other using the same Messuages hath, useth, or occupieth any Lands or Tenements of their own, or others, of the yearly value of twenty shillings per Annum; Nor hath any Lands, Tenements, Goods or Chattels of the value of ten pounds in their own possession, or in the possession of any other in trust for them: And that the said houses have not above two Chimneys, Fire-hearths and Stoves in them respectively. Witness our Hands this 21st day of September 1671.

Widdo Fidgin

John Everitt

Anthony Taylor

Widdo Henson

John Pangburn

Thomas Read

John Leatch

Thomas Norris

Widdo Norris

Widdo Rogers

Joane Page

George Abnell

Widdo Quaint

Waltnee Taperto

Thomas Abnell

John Ratley

Widdo Charnake

Anthony Smith

William Wall

Robert Francis

Widdo Maynard

Richard Wall

Richard Smith

Widdo Knight

Widdo Fitzhugh

Thomas Man

Thomas Burten

Thomas Ashby

Widdo Morgan

William Ley

Adam King

Widdo Walton

John Hart

Richard Perry

Joseph Mitchill

William Pancrust

Richard Evans

Thomas Pye

John Butler

Richard Pancrust

Widdo Gregory

Widdo Johns

Widdo Sutton

George Cooper Thomas Barnard

[Signed by]

Adam Booker, Rector

Thomas Norman, Church Warden

Thomas Gregory, Church Warden

We Allow of this Certificate containing 45 names.

Brett Norton

Thos. Hackett

____________________________________

1672

We the Minister of the Parish of Wavendon in the County of Bucks and Church Wardens and Overseers of ye poore of the said Parish, do hereby Certifie unto His Majesties Justices of the Peace for the said County That we do believe, that the respective Houses wherein the Persons here under-named do Inhabit, are not of greater value than twenty shillings per Annum upon the full improved Rent; And that neither the Person so inhabiting, nor any other using the same Messuages hath, useth, or occupieth any Lands or Tenements of their own, or others, of the yearly value of twenty shillings per Annum; Nor hath any Lands, Tenements, Goods or Chattels of the value of ten pounds in their own possession, or in the possession of any other intrust for them: And that the said houses have not above two Chimneys, Firehearths and Stoves in them respectively. Witness our Hands this 25th day of July Anno Dom. 1672.

Widdo Henson

Thomas Read

John Leath[?]

Thomas Norris

Widdo Norris

Widdo Fitzhugh

Joane Page

George Abnell

John Pangburn

Widdo Fidgin

Widdo Quaint

Waltnee Taperto

Robert Taperto

Thomas Abnell

William Lea

John Ratley

Widdo Charnacke

Anthony Smith

William Wall

Robert Francis

Richard Smith

Widdo Knight

Widdo Fitzhugh

Thomas Man

Thomas Burten

Robert Page

Thomas Ashby

Widdo Morgan

Adam King

Richard Perry

Thomas Barnard

George Cooper

Joseph Mitchill

William Pancrust

Richard Evans

Widdo Sutton

Widdo Gregory

John Butler

Thomas Pye

Richard Pancrust

[signed by]

Adam Booker, Rector

Henry Biggs, Overseer for the poore

William Parratt, Church warden

William Lark, Church warden

We Allow of this Certificate containing 40 Names

B. Norton

Tho. Hackett

Page last updated Aug. 2021.